Pattaya, a vibrant city on Thailand’s eastern seaboard, has long been a hotspot for both tourists and real estate investors. With its stunning beaches, lively nightlife, and modern amenities, it’s no surprise that many first-time condo buyers view it as an ideal place to invest. The city’s real estate market has experienced significant growth in recent years, driven by factors such as the Eastern Economic Corridor (EEC) initiative, the rise of the expat community and a number of condo investor, and ongoing infrastructure upgrades, said FazWaz Thailand.

However, despite its allure, purchasing property in Pattaya can be tricky, especially for those new to the market. Recent reports indicate that the condominium market in Chonburi province saw the launch of 8,700 units worth 25.7 billion baht during the first half of 2024, with 6,997 units valued at 21.2 billion baht launched specifically in Pattaya.

Pattaya Mail also stated that this surge in supply has raised concerns about potential oversupply, making it crucial for first-time buyers to navigate the market carefully.

For first-time condo buyers, it’s easy to make mistakes that can lead to financial strain, regrets, or even legal troubles. Whether you’re looking for a vacation home or a condo investment property, it’s crucial to avoid these common missteps. In this article, we’ll outline five of the most frequent mistakes first-time condo buyers in Pattaya make and explain how you can avoid them.

1. Condo Investor Overlooking the Importance of Location

In real estate, location is everything. Many first-time buyers fall in love with the aesthetic of a condo without properly evaluating the surrounding area. While the unit itself may look fantastic, if it’s located in a less desirable part of Pattaya, it may not be a good condo investment in the long run.

Condo Investor’s Common Mistake

First-time buyers often focus on the immediate charm of the property (e.g., a modern design or amenities) and neglect to consider its proximity to key attractions, transportation, and essential services.

How to Avoid This Mistake

Before making any decisions, research the area thoroughly. Popular and high-demand areas like Central Pattaya, Jomtien, and Naklua tend to offer higher rental yields and long-term value due to their proximity to beaches, shopping malls, restaurants, and public transport systems. On the other hand, properties located far from main roads, tourist attractions, or public transport options may struggle with long-term rental demand.

Ask yourself questions like: Is this location convenient for tourists or long-term residents? Are there future infrastructure projects in the area that could boost or hinder its value? Consulting with local real estate agents or property developers will also help you get a better sense of the area’s potential.

2. Condo Investor Understanding Local Real Estate Laws

Thailand has specific regulations regarding property ownership, and the rules can be particularly confusing for foreign buyers. First-time condo buyers may not fully understand these laws, which can result in costly errors.

Condo Investor’s Common Mistake

Foreigners are allowed to purchase a condo in Thailand, but the total foreign ownership of a condo building cannot exceed 49% of the total floor space. Many first-time buyers assume they can buy a condo regardless of its ownership structure, leading to disappointment or even legal complications.

How to Avoid This Mistake

Before you fall in love with a condo, make sure you fully understand the ownership laws. You can only buy a condo in your name if the building has available foreign ownership quota. If the building is already at 49% foreign ownership, you will need to explore alternative options, such as purchasing the property through a Thai nominee or leasing the property for an extended period.

It’s also advisable to work with a reputable real estate lawyer to ensure that you understand all the legal documents involved in the purchase, and that the sale complies with Thai property laws.

3. Condo Investor Ignoring Financial Details and Hidden Costs

While it’s easy to focus on the upfront price of a condo, first-time buyers often overlook the hidden costs associated with purchasing property in Pattaya. Beyond the purchase price, there are various expenses, including taxes, legal fees, maintenance costs, and potential property management fees.

Condo Investor’s Common Mistake

Failing to budget for hidden costs can lead to financial strain later on. Many first-time buyers mistakenly assume that the listed price is the total cost of the investment without considering additional expenses.

How to Avoid This Mistake

Make sure you understand all the financial details before purchasing a condo. In addition to the price of the condo itself, be aware of the following expenses:

- Transfer Fees: Typically around 2% of the condo’s value.

- Stamp Duty and Taxes: These can add up to 0.5% to 3.3% of the purchase price.

- Maintenance Fees: Condo buildings charge monthly maintenance fees for common area upkeep. These can vary widely depending on the development but may range from ฿30-฿80 per square meter.

- Property Management Fees: If you plan on renting out the property, you may need to hire a property manager, which will incur a management fee.

Make sure you have a clear understanding of your total financial commitment and factor these costs into your condo investment strategy.

4. Condo Investor Considering Rental Potential

While buying a condo for personal use is one thing, buying one as a condo investment is a whole different ballgame. Many first-time buyers make the mistake of focusing solely on the property’s resale value without considering its rental potential, especially since Pattaya is a popular destination for both short-term and long-term renters.

Condo Investor’s Common Mistake

First-time condo buyers often fail to think about how easily they can rent out the property. If the condo is in a less desirable location, has limited amenities, or lacks rental appeal, it may be hard to find tenants, impacting your return on investment.

How to Avoid This Mistake

When considering a condo as an investment property, it’s essential to think about rental demand. Look for condos in areas with high tourist traffic or near key attractions, as they are more likely to generate rental income.

Additionally, consider factors like the condo’s size, layout, and amenities. Units with one or two bedrooms, a balcony, and modern furnishings are generally more appealing to both tourists and long-term renters.

Research the local rental market to determine the potential rental income for properties similar to the one you’re interested in. Many real estate agents in Pattaya can provide rental yield estimates to help you make an informed decision.

5. Condo Investor Neglecting to Conduct Thorough Due Diligence

Finally, one of the biggest mistakes first-time condo buyers make is skipping important due diligence steps. Whether it’s inspecting the property, checking the reputation of the developer, or understanding the condo’s management structure, failing to do your homework can lead to major issues down the road.

Condo Investor’s Common Mistake

First-time buyers sometimes get caught up in the excitement of the purchase and neglect to carefully inspect the property or investigate the background of the developer. This can lead to unexpected problems such as poor construction quality, unfinished facilities, or mismanagement of the building.

How to Avoid This Mistake

Always conduct thorough due diligence before committing to a purchase. Here are some steps you should take:

- Inspect the Property: Hire a professional inspector to check for any structural issues or maintenance concerns.

- Research the Developer: Investigate the reputation and track record of the developer. Have they delivered successful projects in the past? Are their buildings well-maintained?

- Review the Condo’s Financials: Check the building’s reserve funds, maintenance fees, and any potential future special assessments. This can prevent surprise costs in the future.

- Understand the Management Structure: Who manages the building? Make sure there is an efficient and transparent management team in place to maintain the property and handle tenant needs.

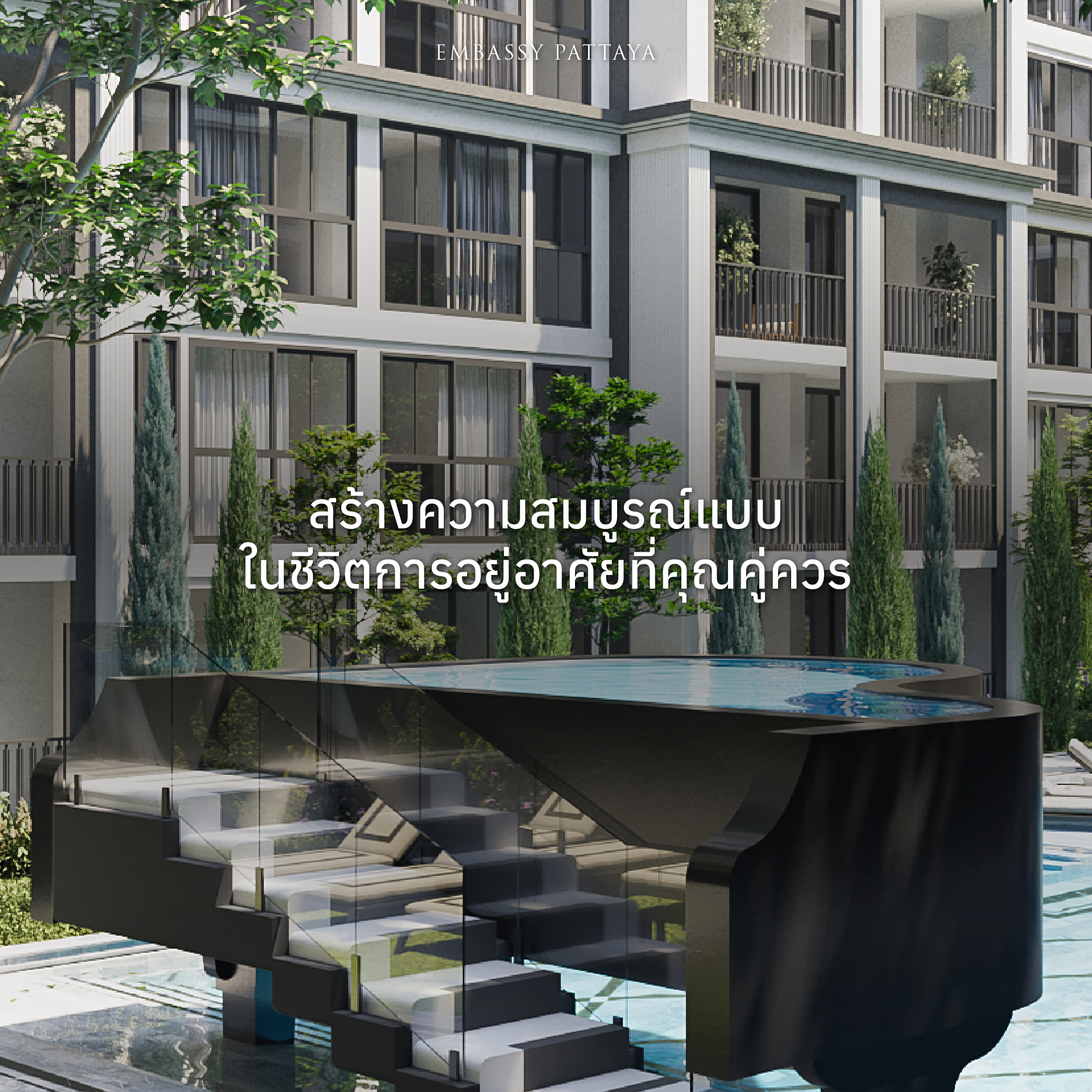

Embassy Pattaya Showroom Welcomes All Condo Investors

Buying your first condo in Pattaya can be a rewarding investment if done correctly. By avoiding these common mistakes—such as overlooking location, misunderstanding local laws, ignoring financial details, neglecting rental potential, and skipping due diligence—you can make a smart and successful condo investment that will pay off for years to come.

Remember to do your research, seek professional guidance, and plan carefully to ensure that your condo purchase is not just a property, but a wise investment in your financial future. Whether you’re looking for a vacation home or a rental property, a well-informed approach will help you achieve your real estate goals in Pattaya.

📞 +66 (0) 83-940-6662

📧 info@theempiretower.com

🌐 https://embassypattaya.com/contact-us/